Catch up with Dave - May 2023

by David Smith, on May 22, 2023 4:50:46 PM

Hello all - as we race through 2023 there’s a lot to update you on; including some regulatory changes, due diligence checking, a brand new agency and details of the next Proprietor Council Meeting.

We'll cover community activities as we reach the end of our Age UK partnership (we're so close to out fundraising target!), and look at savings performance so far, including a review of the ISA season. There's also details of a mortgage loyalty proposition and some mortgage workshops for your colleagues to take advantage of.

Savings

2023 Year to date performance

- We’ve continued to see the Bank of England increase rates, with the latest to 4.50%.

- Our measured approach, balances giving consistently great member value with long-term sustainability on the products we offer. Demonstrated by passing back on 8 out of 11 rate rises since January 2022.

- This has resulted in our overall average savings rate being 113bps higher than the rest of the market, and 156bps higher on average for instant access.

- Look out for the marketing passback campaign in the next few weeks with social activity and retail posters promoting that our savers received £198.6m more interest than the market average in 2022 – a really strong message.

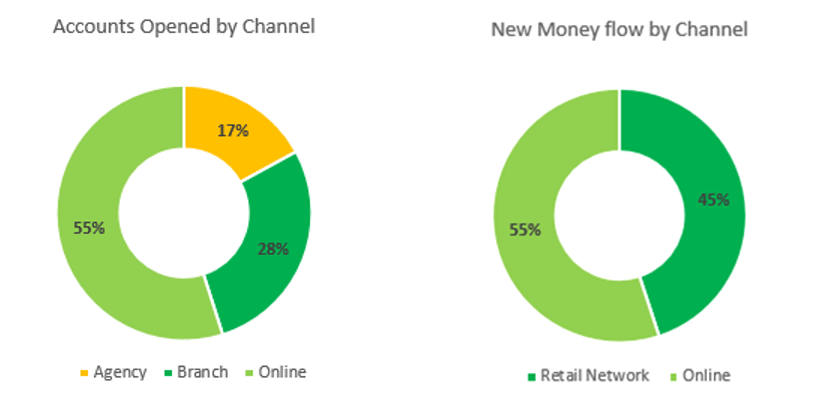

- Volume of accounts opened has remained consistent throughout the last 3 months. Over 38.5k accounts opened YTD in agencies, which is 17% of the total accounts opened.

- Healthy money flows from face-to-face channels, with 55% of new money coming through retail - over £2.5bn overall from agencies and branches. Well done to you and your teams.

ISA Season

- This year’s ISA season was expected to be the largest in many years. Thanks to pre-planning activities across the whole business and well positioned products, including our Loyalty 6 Access Saver ISA, it’s been a resounding success.

- We’ve opened over 100k ISA accounts since the start of March against an aspiration of 75k, 37% of the variable ISAs being opened in the Retail Network. A large uplift on the 2022 season where we opened around 55k ISA accounts.

- We’ve achieved over 95% of the £1.5bn aspiration for new money inflow to the end of May and at the time of writing still have a few days to go.

- The Loyalty 6 Access ISA has been a popular product, with the retail network opening nearly 43k and the online version delivering over 33k accounts. Another well done to you and your teams.

- Overall the Loyalty 6 Access ISA has drawn in over £581m in new balances across all channels, another great way we've rewarded member loyalty.

- In terms of innovation and improvements, we’ve seen an increase in the number of bots at our disposal. This was a great help in ISA season, the bots focused on ISA amalgamations were able to keep up with the increased demand and allow colleagues to prioritise activity in other areas to add value to our members.

Coming Next

- After a successful ISA season, focus turns to how we can maintain momentum during the coming months. It’s really exciting that we continue to truly showcase our mutual model and our purpose of rewarding our members.

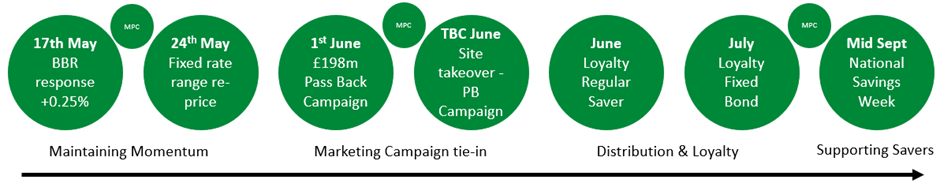

- Plans for our Loyalty Programme are in place with further product launches planned in throughout 2023. In the short term, these are as follows:

- Not shown on the graphic but there are also plans for another Loyalty Regular Saver in September and Loyalty Six Access in October 2023.

UK Savings Week – 2023

Planning is now well underway for the launch on Monday 18 September. This year’s event will build on the successes of UKSW 2022 such as the Money Minds activity, whilst launching a new product, lots of useful content on our website, and activities and materials which will help the week feel a little different for you and your customers. With less than 4 months to go, we're excited to share more details with you on a regular basis moving forward, starting next month. Watch this space…

mortgages

Loyalty Proposition

- We want our members to feel the benefit from being part of a mutual society and rewarded for their loyalty. As part of the broader member savings passback initiatives, we considered how we could also pass on benefits when members take a YBS mortgage.

- Options were considered and most importantly members asked what they’d expect from YBS. Loyalty based mortgages were seen as a good fit, likely to strengthen affinity towards the brand.

- We piloted a mortgage loyalty proposition and then looked at how we could improve it to develop an ‘Always On’ approach, allowing members to easily access this benefit when it suits them. So we’ll add extra cashback to the most popular products from our standard YBS new business range, for both purchase and re-mortgage business.

- It will always be a minimum of £250 cashback and that’s on top of any cashback on the standard range.

- This proposition is aimed at eligible loyal savings customer – they need to have had a savings account with us for 12 months or more. It’s that simple.

- Here’s the good bit. Because we know some of our savings customers may be a bit older and possibly less likely to want a mortgage themselves, we’re also allowing them to pass this benefit on to friends or a family member! This is a Unique Selling Point in the market.

- To pass the benefit on, our customer will need to give their friend/family member a loyalty code to quote when they make a mortgage appointment. An adviser appointment must be made as this loyalty proposition isn’t currently available online. There will be a retail briefing pack soon.

Mortgage Business Partnership Workshops

To help your colleagues discuss this and other benefits of a YBS mortgage, we now have dates open again for our Mortgage Business Partnership Workshops. They will bring to life why the Mortgage Business Partnership is important to YBS, what the programme aims to achieve, how this will be achieved, and the important role that branch and agency colleagues play.

These workshops are for any colleagues who are new to your agency or those who might not be very confident at having effective mortgage conversations. They are now available to book on Learn on the 12, 13 and 23 June. Details and a link were in the Retail Weekly Update on 19 May, or speak to your RAM.

Network Updates

Agency Proprietor Council

- The next meeting is at the end of June in Leeds. This is the first opportunity to meet in person since the Council started in 2019, and Interim Director of Retail Distribution, Brian Reynolds will be joining us.

- I shared the minutes of the last meeting with you at the beginning of April so you can see what was discussed. If you want to suggest a topic, please let your nominated Council representative know ASAP, by 5 June at the latest.

New Agency in Salisbury

- In early April, we opened a brand new agency, the first since 2019. Salisbury was one of our key underserved areas, with the nearest YBS location being over 20 miles away, so this gives us a brilliant opportunity to establish a YBS brand presence whilst providing customers in and around Salisbury with fantastic products and services. We’ve partnered with St Barts Finance who already run our existing agencies in Southampton & Bournemouth. 6 weeks in it has been a great success so far with over 250 new accounts opened.

Due diligence checking

- We’ll be contacting you soon to complete our next round of due diligence activity. This helps us update our records, makes sure we’re holding good quality data about you and your businesses and identify any areas where we’d like to find out a bit more about.

- If you recently joined YBS as an agency partner, or changed the structure of your business, you’ll remember what’s involved, but we’re also taking the opportunity to ask some more detailed questions to help us meet our regulatory requirements.

- This includes the new Consumer Duty which sets higher and clearer standards of consumer protection across financial services (see below).

- Your RAM will be in touch soon to explain the process and talk through what we’ll need from you.

Consumer Duty

- The new Consumer Duty regulation comes into effect on the 31 July 2023. We’ve been doing a lot of work to ensure we’ll meet the new higher standards that are expected for all our customers.

- We have already shared our Target Market and Fair Value assessments and our Customer Communication framework with you (there is a specific section in the Agency Operations Manual).

- There was a Retail Briefing pack at the beginning of the year providing a high level overview of Consumer Duty – just in case you missed it.

- All your colleagues should have completed the e-learning provided and there will be some follow up retail briefs to bring this life for front line colleagues.

- Your RAM will be arranging a meeting with you to talk through both of our roles and responsibilities in respect of the new regulation. We hope these sessions will be informative and set clear expectations for us all moving forward.

Net Promoter Score

- Customer satisfaction service levels for agency customers remains a huge positive for 2023 so far with a +87 net promoter score for the agency network year to date. It highlights that our customers believe they are getting a great service, even at our busiest times with over 400 promoter responses, scoring a 9 or 10. A brilliant score, well done to you and your teams!

Community

Age UK

- We’ve now entering the final weeks of fundraising for our Charity Partner Age UK.

- To date, we have raised £977,245 and are just over £22,000 away from our £1M fundraising target.

- The agency network has raised over £40,000 since the start of the partnership – thank you!

- In May, 214 colleagues from across the Society took on the last challenge event for Age UK, walking 10 or 20 miles across the Peak District.

Yorkshire Building Society Charitable Foundation

- The Charitable Foundation is a key way we can have a positive impact within our local communities and provide support to causes that are important to both our members and colleagues. This is something as a Society, we are committed to.

- Every quarter, we allocate donations to registered charities, with recommendations directly from members and colleagues. So far in 2023, the Charitable Foundation has proudly donated £84,989, benefitting a remarkable 105 charities.

- To help us to be able to continue making donations, we need members to choose to opt-in to the Small Change Big Difference® (SCBD) scheme, donating the pence from their annual interest earned on savings or mortgage accounts.

- We’re aiming for 51% of members to opt-in to the SCBD scheme. At the end of April, the SCBD take-up rate for the retail network was 52% with the agency take-up of 46%.

Cause collection

- We’re continuing to support our local communities by encouraging you to set up/ and or donate to cause collections for local food bank and/or the hygiene poverty charity Hygiene Bank. So far 154 cause collections have been set up with 17 from the agency network.

Thanks,

Dave