Dave's digest - May 21

by David Smith, on May 25, 2021 2:36:39 PM

Good afternoon all,

Welcome to May’s digest. I hope you’ve had a good month, dare I say it more and more things are returning to ‘normal’, and agency business levels continue to flourish. This month I’ll start with mortgages, then I’ll let some others do most of the talking with some really positive updates on savings. Naomi has provided a community update and I’ll finish with some network news – from both an internal and external perspective.

I hope you enjoy it, please let me know if you want any other topics covering in future editions.

Mortgages

Supporting our customers with their mortgage needs continues to be a significantly important part of our role. Now we’ve removed face to face mortgage advisers from our branches, additional support has been developed. A group of colleagues from across the network, including branches, agencies and the Mortgage Team have worked together to develop a mortgage referral options process. This will help you have fantastic conversations with your customers and get them the expert advice they need in a really easy and efficient way.

I’ve mentioned this before for referral agencies, but it is now ready and there is a pack coming to your teams in June. This will help refresh mortgage knowledge, support you and your teams to understand the new mortgage referral options process and get to know the Direct Mortgage Team (DMT). By working together as one team we will be able to help more customers and offer a quicker and more efficient service taking pressure away from colleagues in branches and agencies, meaning your teams can focus on having great conversations with your customers.

Now is a great time to do this. The market remains very strong - April saw the two largest weeks of the year so far for residential applications, and this is in all regions of the UK. The average value of a home mover application hit a new high of £256,000. First time buyer applications went through £2.5bn for the first time this year. Competition across the market remains intense. A large amount of activity is focused on the lower LTV bands with the big six lenders all fighting for top spots in the low value re-mortgage segments.

YBS are creating new records too on applications and completions, having re-entered the 95% LTV tier via Accord in April with a 5-year proposition available to home movers, as well as first time buyers. A reprice since has improved pricing at 95% LTV, as well as taking back some key positions lost to competitors in recent weeks, hopefully you can take advantage of this.

Savings

The savings success that I discussed last month has continued at pace….the agency network balances have grown by nearly £250m this year (which is 5%). 99% of agencies have a positive growth for 2021 with a net account growth of over 14,000. April retention finished at 91% of the £183m that matured. There was ‘just’ £128m maturing in May and as I write, we have retained 95% - this is a brilliant retention performance and stands us in really good stead for two more big maturity months in June and July.

March and April were all about the Loyalty Regular Saver, and that has continued to be popular, but April and then May has also seen the Loyalty ISA come to the fore as part of the traditional ISA season. This month’s blog talks more about how we are hoping the ISA season continues beyond the traditional months, and we’d like you to continue targeting ISA’s elsewhere to consolidate them with you and YBS.

In June we will be supporting our ISA consolidation campaign, your agency will receive a number of ISA consolidation calls, to support customers who have opened a new ISA with us but haven’t transferred any other ISAs in. The data cut has produced a smaller volume so there will also be some Product Tier/Limited Access calls, which have good success rates.

The current ISA material will be replaced with Always On from June, but the ISA consolidation internal poster can still be displayed. More information on the material to display will be with you before the end of May.

Tina Hughes, Director of Savings, has also announced further positive news for our savers (and you) -

“Following the implementation of the revised minimum rates in January and the introduction of the loyalty products (very successfully as Dave has noted above), I'm delighted to announce that next Wednesday, 2 June, we will be applying a further increase to the lowest rates we currently pay on our savings accounts.

These next waves of changes we are making will see a further 1.69m members receive an increase in their interest rates, with unrestricted access variable rate accounts increasing to 0.50% and restricted access variable rate accounts increasing to 0.55%.

This rate increase is another positive move and will further reinforce the support for our loyal customers at a time of continuing low interest rates, and at a time when so many of our competitors are reducing rates or completing one sided rate changes this really re-enforces the positive message of what being a member of YBS means.

Over the next five years we are committed to growing our savings book and increasing our mortgage lending, we want to be competitive in both markets whilst remaining sustainable, and rewarding our members goes hand in hand with this aspiration.

Finally, we’re also really excited to be launching another loyalty product on Monday 2 June, look out for further information on this Loyalty Six Access Saver (non-ISA) next week”.

I talked last month about the need to focus on variable rate retention so this should certainly help with this as well as attracting funds. I’m sure this is welcome news for your balance growth plans. I also mentioned the opportunity outbound calling brings, and I wanted to provide an update on some data we have gathered to measure the success of this. As some of the agency calls were done using manual lists, this data relates to branch calls, but the call type and data selection is the same as yours, so the principle is the same. One of our retail area managers, Adam Hogan has been leading this for us -

“In April, you’ll recall that we rang customers who were eligible for our Loyalty ISA, using internal and external data to try and put you in touch with the customers most likely to benefit. We have seen some resounding commercial success from these calls – we can estimate that the 1,500 customers we reached have grown their balances by approximately £5m in the 4-5 weeks since we called them. We also have the data to approximately compare their balance growth in May to the average customer, and it’s fantastic to see that their balances grew at more than double the rate of the average (213%). Thank you again for all of your hard work – almost a year after we relaunched ‘outbounding’, we now know beyond doubt that it has had a really significant impact on both our customer experience and our savings performance.

Thank you also for all of your hard work on the Regular Saver Review calls in May; we hoped that these would present a great opportunity to go back to all those Regular Saver customers who opened accounts in March and April. The feedback on these calls has been largely excellent, and your enthusiasm for them has come through loud and clear”

Community

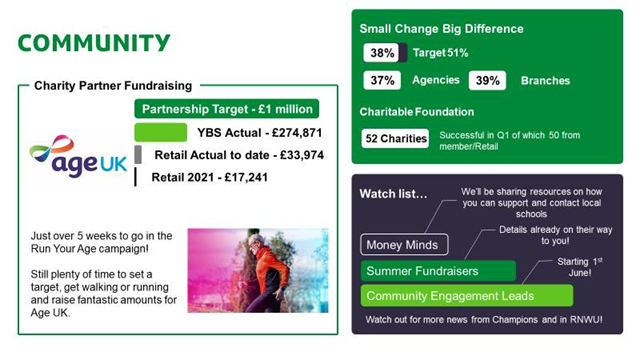

Our Community Engagement Manager Naomi has provided a detailed update, illustrated in this graphic and also with an update below on Small Change Big Difference, Age UK, and our plans for purposeful investment in our communities.

Small Change Big Difference:

- By the end of April we were still coming in at 38% for retail on the whole, with agencies at 37%. To help that number creep up, we’ll need to keep driving uptake rates and demonstrating the relationship this has to the work of the Charitable Foundation.

- The Q1 Charitable Foundation outcomes have been released with 52 donations being made, 14 from the agency network. There’s a fantastic array of charities supported which can be viewed with your Development Manager through the MI pack. Why not share successful nominations on your community board and celebrate with customers.

- Q2 nominations are now open until the end of June.

Age UK:

- Just 5 weeks to go on the Run Your Age campaign. Across the business people have been walking virtual marathons, taking on step challenges, or just clocking up the minutes with a walk and natter. Together, we’ve raised nearly £8,000 and we’re pushing towards our goal of £10,000 for the end of June. Why not join with us, contact Community team for more information.

- With the funds paid in to end of April our retail contribution for the partnership so far is an amazing £33,974 with £17,241 raised this year of which, £2,495 is from our agency network!

- Your next opportunity to get fundraising is through our summer fundraisers. Details were provided in the retail weekly update on 21 May – but you can expect to see sunflower growing competitions and sweepstake kits to help with the summer of sport we have coming up. Make sure to use your budget to boost your fundraising.

Purposeful investment in our communities:

- You’ll remember back in April we shared news about the Board commitment of over £800K for 2021 in response to the need within our communities, particularly considering the ongoing impact of Covid-19. We’re working towards two key themes over the next two years:

- Helping at least 40,000 people achieve greater financial wellbeing.

- Helping at least 2,000 people in our Bradford heartland improve their skills and progress on their journey to employment.

There’s been lots happening behind the scenes, here’s a flavour:

- We’ve recruited our new Community Engagement Leads: Camilla Banthorpe will be supporting the Scotland & North Region, Bethany Shipley will be supporting the South Region and Kerry Shaw, will be supporting the North Region and also agencies. As some of you will know, Kerry is one of our DM’s but is taking up this role as a secondment, so is a real agency SME. They will be starting in their roles from 1 June and will help develop best ways of working for community programmes in retail going forward.

- Citizens Advice pilot launched w/c 17 May.

- Development started on digitising Key Stage 3-5 Money Minds materials.

- Workplace Savings Pilot is well underway with four employers signed up to onboard with us.

- Partnered with the Good Things Foundation to start work on our Bradford Community Digital Skills Programme.

- Partnered with six Bradford schools, colleges and universities to begin delivery of a structured programme of employability skills, meaningful workplace experiences and access to careers.

Thank you

- Finally, we just want to say thank you for supporting our communities! It has been fantastic to see your efforts behind fundraising and through the Charitable Foundation. We can’t wait to see what happens through your summer fundraisers and your SCBD focus.

Network Updates

Alongside YBS network updates, I have this month included a link to an independent report that discusses the future of branches in a post Covid world. It is aimed at the whole market including banks, where some of the changing trends are more exaggerated, but there is plenty in there to encourage you and us about the future and how we can capitalise on this with our face to face footprint, on top of the encouraging growth I talked about at the beginning of the digest.

Although the planning of our Strategic Blueprint was in flight prior to Covid, so not designed with that in mind, there are some parallels with our plans and this view of the future. We recently held a Retail Leadership Conference about our three year face to face transformation programme. It’s all about making the most of our high street presence to help deliver our Strategic Blueprint, bringing benefits for customers, communities and our colleagues. You have hopefully seen the first pack as this will be cascaded to you and your teams via a number of retail briefing packs over the next few months.

Finally, we have now hit 110 agencies, as Ilkley branch was converted and opened as an agency with a brand new proprietor on Monday 24 May. There are more in the pipeline, if expanding your own business in this way appeals, please let me know.

I hope you have a great bank holiday weekend.

Thanks

Dave