Dave's monthly digest - December 20

by David Smith, on Dec 15, 2020 3:18:42 PM

Good morning All,

Welcome to December’s monthly digest!

I hope that this message finds you well, and you’re looking forward to the Christmas break.

Firstly, many thanks to you and your teams for the hard work, commitment & resilience you have displayed in the most challenging of years. You'll see in this message that there's lots to be proud of.

The last Digest was about our Strategic Blueprint, so this is the first ‘normal’ digest for a while. This final 2020 Digest will cover the usual topics and reflect on this year, which as we know, has been far from normal. We’ll also look ahead to what we all hope will be a better, happier, healthier & less disrupted 2021.

I’m really keen to hear your plans for 2021. Your DM will be having and documenting this discussion with you shortly. So please give this conversation the focus it deserves, as per your obligations as a proprietor. We need to make sure the investment we make in agencies is matched by engagement and accountability from you to ensure the relationship is mutually prosperous.

We’re also using this last edition to look back over the Growth Series content we’ve provided this year.

Don't forget that all previous Growth Series blogs are available here.

Savings

Starting with savings, the story of the year tells us that after a promising start and healthy balance growth in Q1, the first lockdown understandably brought significantly reduced transaction volumes in Q2. Whilst outflow didn’t particularly spike, new accounts and new money all but dried up, which had the impact of reducing net balances.

More on the 2020 savings roundup

If you recall, we were also dealing with the lowest ever BOE base rate after 2 reductions, so the savings market was already a challenging place to be. I covered this in earlier Digests. We then had a gradual increase, first of transactions and then of new accounts and new money, as operating hours and customer behaviour started to return to pre lockdown levels.

Whilst there are still restrictions in place (with some parts of the network more impacted than others), we have seen the total net agency balances grow every week in Q4 so far. So I’m encouraged that 2021 can mirror 2019 instead of 2020.

Whilst the circumstances will have undoubtedly had an impact on your own 2020 growth plans, 75% of agencies have still seen positive growth. Your DM will be speaking to you in the next couple of weeks (if they’ve not already done so), about setting challenging growth plans for your agency in 2021, and discussing your specific actions to achieve this. These will be reviewed with you on a regular basis. It is important they match our own ambitions as we start the ‘savings rebooted’ journey. I asked Richard Conway (Savings Product Manager), to share his thoughts:-

As I highlighted in my recent intranet article (which you can also find here), a really tough and successful year has brought out the best across the agency network (I take my hat off to you all once again), and from a product perspective it’s been great to see that some of the new additions to the range have been well received.

2020’s weirdness has led to some unforeseen market behaviours, not least the good people at NS&I jumping in-and-out of the savings space and causing havoc for the rest of the competition. We’ve made the most of these opportunities; showing that restricted access products like the 6 Access Saver fulfil customers' need for access– while allowing us to offer them a higher rate than a typical ‘instant access’ account.

We’re looking to next year with optimism and some pretty big aspirations to build on this year’s success. At the moment, the forecasting and planning process is doing the rounds, so there are no specific numbers to share, but we’ve worked closely with Dave and Gary to ensure Agencies play a big part – knowing that the more entrepreneurial spirit that comes from owning your own business can match the ambitions that YBS has to grow its savings base.

Some things I can share is that our Savings Propositions team have been hard at work in the background to broaden the product range – focussing on unmet needs and opportunities to bring several new savings products to the table during 2021. These will be phased through the year, and will land at the best times for you to strike up conversations with customers.

Moreover, Dave and the Development Managers continue to enhance the tools they use to support you in your growth aspirations for your agency. This will put some more science into helping you grow, and everyone is excited to start using these.

From a ‘balance growth’ perspective, I can’t over-emphasise how critical the agency network is to our ambitions. I’m confident that – as we raise our game to deliver these new products and innovations – you’ll be matching us step for step and sharing in that success.

Mortgages

Given that our two primary markets are so closely interlinked, we saw the same roller-coaster ride in the mortgage world in 2020. From the extremes of the market being pretty much closed, to multiple record breaking months. We also had to adapt to the huge demand for support in the shape of payment holidays, which had a subsequent knock on effect on the direct mortgage offering, with branches acting as call centre overflows as we reallocated resource within the business.

More on the 2020 mortgage roundup

The Mortgage Market continues to be fairly buoyant. Moneyfacts has recently commented on the ever increasing number of products available to mortgage borrowers, especially in the 90% LTV market. Here, the number of products available is up 57% month on month (although still only a fraction of what we saw this time last year). Halifax and Virgin are the latest to re-enter the 90% market. As you may know, YBS Direct & Accord are also back in the 90% market and volumes are manageable considering the time of the year, and are in line with current plan.

Halifax has issued some commentary to the market claiming house prices continue to surge, with an average increase of 6.5% since June, the most substantial 5 month jump in 16 years.

All the above continues to be influenced significantly by the current temporary stamp duty rules, due to end in March 2021, when we may see the market change, but obviously we won’t know until it happens. Until then we, like all lenders will continue to maximise margin opportunities (especially in higher LTV brackets) whilst keeping an eye on their risk exposure position.

Following recent announcements that I have shared with you, there will be some YBS changes in 2021. For brokers you will see Direct & Accord functions more closely aligned, so please be mindful that both brand options are available to you. For referral agencies, you will have access to the diaries of the whole Direct Mortgages team, increasing the appointment options for your customers. After real progress in 2019, referrals have dropped in 2020 (for already documented reasons), but I hope we can see this go back in the right direction in 2021. We have recently shared a guide with your teams to help answer customer queries, and in early 2021 we will be sharing a workbook to help your colleagues to generate referrals – 24 agencies earned income from this in 2020.

Looking back at the digest from the beginning of the year, the ask of the then Senior Manager for mortgages was that “we take the opportunity to talk to all appropriate customers about the award winning range of products that we offer”.

Whether this is from those who submit direct business, or those of you who refer, I would like to repeat this request and ask you to talk to customers about our mortgage range wherever feasible. For those who submit direct business, hopefully the bespoke guide here that we issued this year, has helped you to navigate this process.

Network Updates

Even in a challenging year, we have made some progress, and the Digest has shared lots of good news and improvements in 2020. Your teams now benefit from Single Sign On, so they only need to remember one password to gain access to all YBS systems. We have also enabled individual e-mail addresses for all agency colleagues who use the YBS system, bringing benefits such as encouraging communication across internal teams and getting ready for Office 365 roll out in the future.

More on the 2020 network roundup

Agency colleagues can also now access ‘Ignite’, an internal platform which encourages engagement with colleagues across the YBS group on all subjects, and allows for local groups to be set up to share ideas and best practice. We also refreshed and relaunched the Agency Hub here which gives you access to an online microsite packed with information and support to help you to grow and promote your YBS agency business. In summer we made the ‘Mindset, Language & Actions’ training modules available to you and all your colleagues. I hope the rollout of this is going well - I have heard lots of positive stories on the impact it can have. We have also established the Agency Proprietor Council, and hope to make this more visible in 2021 and ensure the Council represent the views of the whole network.

IT Update

I know it seems like the WAN upgrade has been going on for a long time (the pandemic certainly didn’t help), but we now have all Agencies' hardwire connected with at least one internet connection. Just over half of our agencies are running on dual links, but 51 Agencies are still running on one circuit. Most have the circuits installed, they just need a visit to connect it up to the Meraki kit. From a timescale perspective, it’s with Virgin to roll out the remaining connections – and I’m expecting this all to be done before the end of February.

I have also shared the plan for the server upgrades and for the majority of who this applies to, you have a date for this to be replaced between the end of January and end of March 2021. Thanks for accommodating this and allowing it out of hours, it is much appreciated. It’s a busy schedule in over 250 locations across the UK. The next stage will be the rest of the desktop refresh, dates to be confirmed but hopefully by the middle of the year.

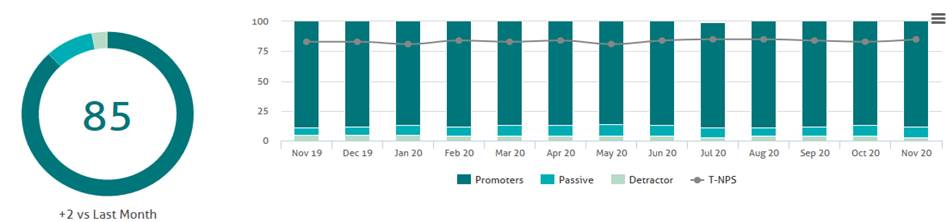

Net Promoter Score (NPS)

One thing that has remained constant is the excellent service you and your teams provide for our customers. As you will see below, at the latest update, the rolling 3 month score for the agency network has gone up to 85 – which is a consistent high for the year (and the lowest score has only been 81).

This is a tremendous achievement considering everything that’s been going on this year, so you and your agencies should be really proud.

So what’s the challenge in 2021? As we start to focus on ‘Properly Personal Experience’, can we see an increase in every outlet?

Branch to Agency Conversions

After a short hiatus, this recommenced in the autumn when we welcomed 2 brand new proprietors, and converted Sunderland & Chester branches into agencies. There is a further pipeline in progress, and I will keep you informed throughout 2021 as the agency network grows in both size and strength with more conversions and possibly some new locations.

Finally

Community: This year has been far from easy, but through your determination, we’ve still been able to support our communities and show that we care. We’ve ended one charity partnership and begun another, collected items for much-needed causes in points of crisis and recommended hundreds of charities to benefit from the Charitable Foundation!

Thank you for your continued involvement.

More on the community roundup for 2020

New Charity Partner – Age UK

Cast your minds back to earlier this year – we asked colleagues, members and a selection panel to help us choose our next charity partner. On 16th November we announced that Age UK had pipped Clic Sargent and Barnardos to the post, to become our new charity partner until 2023.

We’ll be aiming to raise £1 million to support Age UK in Building Better Lives. Our partnership will focus on providing advice, support and care when older people need it most. Over 2 million older people are currently living in poverty and 2.6 million feel they have no one to turn to. We’re partnering with Age UK to ensure that older people have somewhere to go in times of crisis. The partnership will pilot and roll out a programme of one to one advice that builds financial resilience through accessing available funding, benefits and support. We’ll also be working with Age UK to create key financial milestones guides that can be accessed across the UK. These guides will breakdown the jargon and bring simplicity to build and boost the financial resilience of older people.

You’ll know that we’ve already kick-started our fundraising! You may have had some hampers in agency or some of the new Christmas POS items to share with customers. Hopefully you were able to get involved with our central fundraisers recently with the Christmas raffle that closed this week, and today’s Christmas jumper day. Next year we’ll be sharing news of our bigger fundraising events, new POS items and activities lined up for our retail network, as well as getting colleagues fully clued-up on the partnership programme and the impact it is having across the UK.

Charitable Foundation – Q3 Donations

Back in November, alongside the Community MI pack, we shared news of the latest Charitable Foundation donations for Q3. Since then we’ve had a flurry of news releases that have been picked up by local media to celebrate these nominations! Whilst we know not every release is printed, you’ve got to be in it to win it! As we know, media coverage like this can be really positive for business and shares the great ways we are supporting our local communities.

You can find out if your agency has had a successful nomination by logging in to the Community Hub, (Quick Links > Community Resources > Charitable Foundation donations 2020 Q2/Q3 breakdown). And whilst you’re there, why not familiarise yourself with the next steps after your nomination has been successful? (Charitable Foundation > Quick Links > Successful nomination - next steps).

Q4 nominations are open until 31st December. If you have not had one this year, please speak to your DM about how you can change that in 2021.

I hope you have enjoyed reading this edition of the Digest, and are as excited and motivated as my team & I are about the opportunities we have to grow the agency network in 2021. All that is left for me to do is to wish you, your teams and your families a wonderful Christmas and Happy New Year, and I look forward to speaking to you all in the not too distant future.

As ever if you have any feedback, please feel free to share.

Growth Series - A roundup of 2020

As it's almost Christmas, this month, we bring you a roundup of the Growth Series content we've provided this year. We hope you find it a useful re-cap and a reminder of how the content can help you, both now and in the future.

Go to the Growth Series roundup

We'd love to hear your views

Please let us know how useful you find these emails by clicking one of the faces on the bottom of the email.