Dave's monthly digest - February 21

by David Smith, on Feb 26, 2021 9:46:06 AM

Good Morning all,

and welcome to my latest digest. Hopefully you will have all seen last week’s message announcing our annual results here. I’m sure you’ll agree they were very strong, and, along with Mike's comments, tell the story of a challenging but ultimately successful year. All I would like to add is to further underline his thanks for the contribution that you and your teams made to this. I won’t dwell any further on the results, but will instead cover the usual topics, starting with network updates & news and a new feature.

Don’t forget that all previous Growth Series blogs are available here.

Network update & News

A new feature of my digest is called “Agency in Focus” where periodically we will look at a different agency to see what measures they have put in place to set themselves up for success. Insight from the proprietor and agency colleagues will help us build a picture of what a successful agency looks like.

For this first feature we will be looking at Downend agency.

More on Agency in Focus

In 2020, they managed to grow their savings book by over £8m. An increase just shy of 11%. This not atypical for the agency, as in recent years they have seen regular growth similar to this. We spoke to the proprietor Ian and his team to get their account on what they believe Downend are getting right:

Q: You managed to grow your book by 16% in 2019 and by 10% in 2020. What do you think are the main reasons for your success?

A: We are very pro-active with growing our balances, every day we record how much we have brought in, how much we have given out, how many customers we have seen and what accounts we have opened, it really spurs us on. We fight for every account whether it is a closure or a maturity. But more than anything else it is down to the personalised customer service we provide. We make an effort to get to know our customers really well. A smile is transported into your voice; we greet all our customers with a happy, smiley face which makes the customer feel welcome and at ease. We have gained many of our customers from recommendations about the experience friends/relatives have received. Being knowledgeable about our products gives the customer confidence and trust in us. As a team we discuss the new products and any questions which are not covered in the YBS briefs are sent to the DM. In doing this we make our agency a one stop shop for all of our customer’s needs.

Q: What has been your biggest learning over the recent years?

A: Making the Agency as “YBS” as possible and separating/distancing away from our core business has really made the operation more professional and in line with YBS branding and values. We made a call 2 years ago to make sure our core business operations did not impact on the agency so that it remained as professional as possible whilst giving privacy and security. We introduced a separate door for agency customers, and this made a massive difference and makes the Agency feel much more like a Branch. A longer time ago we decorated the agency in YBS colours and this helped give confidence to customers that we are more professional and linked to YBS directly. Our core business does not impact on the visual street view of our agency which also gives prominence and trust.

Q: What would your take-away message be to the rest of the agency network?

A: Really engage with the locality, give staff the chance to lead the service delivery, work closely with Development Managers/YBS head office representatives and keep agile so that adaptions can be made simply without impact on the operation. As an agency we always go the extra mile; we send cards to customers (birthday, get well soon, Xmas) and utilise surprise and delight. We include pre-stamped addressed envelopes when sending postal forms. Even little things like a bowl of mints on the counter, and we didn’t realise how much they were appreciated by our customers until they had to be removed for Covid reasons.

On the back of this, I asked Martin, the DM his views on what it was like working with this agency. He said:

A: 'I really like their passion and desire to grow their business. They see it as a challenge; they set themselves goals to achieve on a yearly, quarterly, monthly and weekly basis and strive really hard to meet these goals. They have a strong focus on both growing their book and retaining what they already have. When I pick up the phone them, they love to tell me exactly what they have done that week, how many accounts they have opened, the amount of money this has brought in - their passion really shows through. They’re not afraid to try new things and embrace new ways of working such as outbound calling and this has brought them great success too. Additionally, it has always been obvious to me how connected they are with their customers. When I would visit I could see how well they knew and got on with them, it’s always very personal.'

Training & Competency

As you are aware the Scheme minimum is to complete an Observation of an account opening per person (where appropriate) per half year. We have updated the scheme “Observation Guidance” document. It is only a minor update to reference that we have removed the “Informed Choice – Principles” as a standalone document and has instead been moved into the ‘Scenario Support’ document. Please take the time to re-familiarise yourselves with these documents – both of which are in on Sharepoint in the T&C section.

We have also produced a Counter Observation Form to complement the T & C activities that you already complete. This document and activity (which is additional and sits outside of the scheme minimums activity) will give you the opportunity to coach and develop your team and will naturally help to fulfil your Agency Growth plans.

A reminder of the benefits of T & C activities and how the counter observation will fit in:

- To provide an effective framework to develop, manage and mitigate people risk

- Enabling colleagues to attain and maintain competence

- Enable colleagues to perform better, reduce errors and consistently deliver the right outcomes for customers

- An opportunity to develop colleagues who don’t “Open Accounts”, making them feel valued and confident in their role

- Help to identify any wider business opportunities that may be missed.

The T&C Training Guide we produced and published last year contains all this information and more.

Bright Ideas

Our Process Improvement team are relaunching the Bright Ideas portal for submitting suggestions from the branch and agency network. We still think that it’s a great way for gaining feedback from colleagues about better ways of working, not just for staff members, but also for customers.

Your teams will notice some visual changes on the Intranet, as the team updated their logo. The site will also provide more guidance and structure when submitting suggestions. Please encourage them to spend some time exploring the site from 8th March. The team is also introducing a Quarterly focus (BIG IDEA), which is something we’d like you to consider when submitting suggestions.

Digital

An update on our progress in the digital space, both in terms of improving our infrastructure as well as our customer offering:

- The branch and agency server migrations are going well – we’ve completed 87 of the servers in the network, which is just over a third of the total planned. Upgrading these servers gives us more security and makes it easier to fix any issues. It is also the next gateway for improved systems for your teams.

- Some of you might have seen on the intranet that we recently passed the 100,000 downloads milestone for the app! It’s exceeded our initial download target within five months of going live.

- We’ve introduced a webform for customers interested in our Loyalty Regular Saver - they can submit one to request a call back or application form from their local branch or agency – I know this facility has been very much in use already in the last few days!

Savings

After we increased the minimum rate on many of our variable accounts last month, I said we were planning to further reward loyalty as the year goes on. I’m sure your teams have been busy opening lots of loyalty regular savers. With a market leading rate, and generous monthly deposit allowance, we expect lots of your loyal customers to benefit.

More on savings

Next up will be a Loyalty ISA in March (see this month’s blog for more focus on ISA’s). As explained last month, the primary aim of these products is to ‘give back’ and demonstrate the value of mutuality, but we hope this will also lead to strengthening those relationships and conversations to attract other funds they may hold elsewhere.

We are expecting our savings balances to grow by £1bn in 2021, but to achieve this, as well as attract new funds we need to focus on retention too. I mentioned last month our tremendous performance in retaining fixed rate accounts in 2020. We have £7.9bn maturing in 2021, the majority of this in the retail network, including over £2bn in agencies, so maintaining this retention success is crucial. So far this year with over 90% retained in Jan & Feb it’s looking promising. Your Development Manager can give you some insight on your own maturity volumes, and your teams will be provided with calls to help you manage them.

Last year we saw a large outflow from our variable rate products, which we’d like to address this year. We have recently shared a ‘best practice’ guide with your teams to help with this – so reducing outflow and closures should feature prominently in your monthly growth plan discussion with your Development Manager. When combined with the focus on attracting new money we should see you achieve your growth aims and ours.

Mortgages

Continuing the trend of the last couple of months of 2020, the 90% LTV market has been very much the centre of focus so far in 2021 as more lenders returned to that tier. HSBC, Santander, Coventry, Leeds BS, The Nottingham, Hinckley and Rugby BS and Skipton BS all re-entered the 90% LTV market in January.

More Mortgage updates

With this saturation, lenders have started to significantly reduce rates and expand their ranges within the tier. Halifax and Barclays extended their offering from first-time buyers only to all home movers, with Barclays also bringing back 2 year options. Despite what felt like a busy month of rate changes in all tiers, both the average two-year fix, and the average five-year fix remained static from the beginning to the end of the month, with the average rate standing at 2.52% and 2.70% respectively – the gap between the two at record lows as I mentioned last month.

As is becoming more commonplace in January, there was a greater onus on remortgaging, with more than a quarter of all applications attributable to those looking at new arrangements.

YBS have also taken the opportunity to reduce rates at 90% LTV to improve our competitive positioning, as well as introducing fee free options and this has started to drive higher volumes and we are now tracking ahead of plan. Please encourage your teams to look for opportunities to help customers who have a mortgage need, either moving home or switching deal. We will be providing a workbook later this quarter for your teams to help to spot opportunities and provide a refresh on the referral process.

Finally

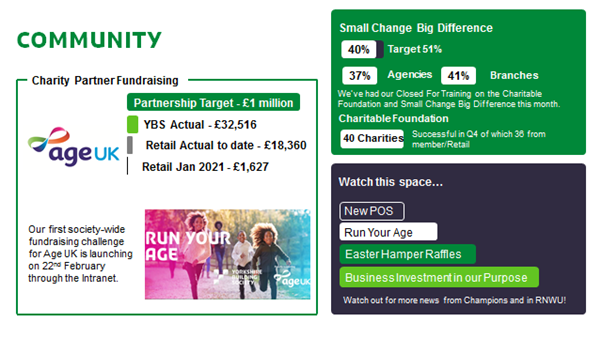

Small Change Big Difference: By the end of January, SCBD was at 40% for the network (37% for agencies). We’d love to see that figure climb throughout the year to reach our target of over 50%.

More on community updates

The image below summarises our current position on community projects.

Your teams will have been through a Closed for Training at the end of February to really help focus our efforts on Small Change Big Difference and to grow the uptake rate in all the ways we can. 2020 Q4 Charitable Foundation decisions are in, and we were able to support 40 Charities through the Foundation, 4 of which were attributed to agencies.

Age UK

Our partnership with Age UK is now fully in swing! In January retail added an additional £1,627 (£397 agencies) to the tally, taking the overall fundraising total to £32,516. Our next opportunities to make an indent in our £1million target are through our Easter Hamper Raffles, new POS item and our first society-wide fundraising challenge – Run Your Age. There’ll be more details on all of these over the next few weeks in the Retail Network Weekly Update.

Agency Proprietor Council

I have mentioned in previous digests that we have established a proprietor council, and one of the key aims of this was for them to represent the wider proprietor population.

To facilitate this, I will allocate each of you with a council representative – and I will send you their details this week.

The purpose of this is to encourage proprietor engagement, and provide you all with an avenue to bring things to the council meetings via your representative. I should also stress that this is not to replace your existing channels of communication with your DM, and directly with me if you have a specific query for your agency.

If you have any queries about this, please let me know.

The Agency Growth Series

This month, with ISA season just round the corner, we're talking about Cash ISAs, with a particular focus on the transfer market and the opportunity it brings. Go to the blog here.