Dave's Monthly Digest - July 2021

by David Smith, on Jul 26, 2021 2:01:40 PM

Good morning and welcome to July’s digest.

This month’s update will cover savings performance and opportunities, mortgage referrals and the usual community and network updates including the proprietor council. There is also an excellent podcast discussing the benefits of embracing the T&C scheme. We’ll be announcing our half year results on Thursday, so you’ll get a further message then from Mike with more details.

Savings

We recently reached a significant milestone in the retail network, surpassing net savings balance growth of over £1bn in 2021. Last month I mentioned we’d revised our savings ambitions for the year and we're aiming for £2.3bn growth. As I write we’ve already achieved £1.9bn, with £1.1bn coming from our retail channels (branches and agencies). Your agencies have contributed roughly 30% of this with growth of £340m. Every single agency is showing a positive growth in 2021 and in total agency balances have grown by 8.5% year to date. A really excellent contribution – well done!

I’m sure I sound like a broken record, but both attracting and retaining funds are crucial in this success you have helped deliver. Both will continue to be crucial to; maintain this success, to achieve our annual aims, and for you to achieve your own growth targets that you have also recently revised with your DM.

Fixed rate retention performance remains very strong with over 90% of fixed rate maturities staying with us in June. A couple of things to help you with attracting funds that I flagged up last month were the use of local marketing and utilising the T&C scheme to develop your colleagues. On the back of last month’s blog on local marketing, Gillingham and Giffnock agencies have taken advantage of creating an advert to use in local publications, and Carlisle have ordered leaflets to do a door drop to promote the agency in their local community. I’ll look forward to hearing about the impact that has. This week’s blog content focuses on the other growth tool I mentioned, namely Training and Competency and there is a Podcast for you to listen to, where Lauren Selby our Bournemouth Agency Manager talks about the approach she takes and the subsequent success it has brought for her team and agency in 2021.

Our products remain competitive, and our current loyalty offering the 6 Access Saver continues to be popular, and based on current run rates will be around until early October. Whilst we have mailed customers about our ‘raise the floor’ activity (a pleasant surprise to get a letter about a rate increase that they won’t be getting in their mail from other providers), driving balances into the back book range will also require some proactivity. This could be at the counter, in savings meetings, during outbound calls – all things you can monitor as part of your T&C activity. The loyalty activity will continue into next year alongside other new and exciting propositions that you’ll hear more about later this year.

Mortgages

The mortgage market remains fast paced and highly competitive. We’re still seeing continual downward pressure on rates with lenders making significant cuts across all LTV tiers. Meanwhile, increased rate competition has led to reductions in both the overall average two-year and five-year fixed rates over the month for only the second time in the past year, with lenders working hard to entice borrowers. It’s a great time for homeowners to look for a remortgage deal which our Mortgage Advisers can help with! The new agency mortgage referral system seems to be having a positive effect, and as hinted last month, June turned into the best month of the year so far, and July is shaping up well. I would repeat my request for you to provide feedback to your DM on the training and information modules created to support your teams so we can continue this upward trajectory, and develop an additional income stream for you. On the subject of feedback, you’ll be pleased to know that your DM will be able to provide you with regular feedback on the leads you have generated so you can keep track of any potential applications (and referral fees) and also understand if and why a case couldn’t proceed.

Community

Please see below for Naomi’s monthly update:

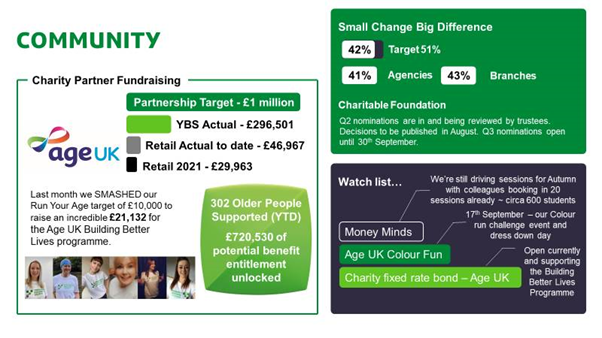

Small Change Big Difference:

- We’ve seen uptake rates remain steady at 42% overall, with agencies reaching 41%. Thanks to your teams for continually driving the uptake rate on those new accounts. We’ve seen agency uptake climb 2% over the past month!

Charitable Foundation

- Q2 Charitable Foundation nominations are now with the Trustees with decisions being published in August through our Community newsletter and MI pack. Q3 nominations are now open with the deadline of 30 September.

- The first annual round of the new strategic ‘Opportunity & Resilience’ Charitable Foundation Fund, part of the £800,000 investment by Board into our communities has been announced. The Foundation has supported Refugee Action, Smart Works, Canopy Housing and Groundwork North East & Cumbria with a combined £100K to drive projects related to digital skills and employability a key focus of the Purposeful Investment in our communities.

Age UK:

- We’ve smashed the initial Run Your Age £10,000 target and have raised £21,132 for Age UK. As if that wasn’t impressive enough, the funds raised have been matched by the business to make a huge final total of £42,264! Over 230 colleagues took part and helped to raise this incredible amount.

- In the banking hall, we’re still driving our summer fund-raising activities. Your teams have sunflower seed POS items, sweepstakes packs (think about the Olympics!) to get up and running helping to sow a little happiness with our customers whilst raising vital funds.

- With the funds paid in to end of June our retail contribution for the partnership is a fantastic £46,967 with nearly £30,000 raised this year of which £3,314 is from our agency network.

- 44% of agencies (up 4% from last month) are involved with the Age UK partnership and we’d love to see that climb to the levels we’ve seen in previous years. Get in touch with our Community Engagement Lead for Agencies, Kerry Shaw (klshaw@ybs.co.uk) if you would like further support in getting your fundraising going.

- Collectively our partnership total sits at over £296,000! And since the partnership began, Age UK have supported over 302 older people to gain great financial wellbeing through the Building Better Lives Programme. The 1-2-1 bespoke sessions have helped unlock £720,530 of potential benefit entitlement.

Money Minds:

- Improving financial resilience in younger people is one of our core business aims. This autumn colleagues are preparing to deliver financial education sessions (Money Minds) to Key Stage 1 & 2 students. If your agency would like to reach into your local community using the Money Minds materials for primary school children, you can contact Kerry klshaw@ybs.co.uk and she’ll support you and share the resources you may need.

Network Updates

Agency Proprietor Council

We recently held the quarterly Agency Proprietor Council meeting, with guests from the Savings Trading and Community Teams, eager to both share their plans and get some proprietor input. You will all hear more about these plans in due course as they become fully formed. I also shared the detail of our Business Outreach Programme, which I would love agencies to get involved in when it is fully launched in the autumn (and the council agreed). This week’s retail brief gives you a taster of the plans which I hope you can help drive.

One of the aims of the council was to encourage networking, and for you as proprietors to contribute to the agenda. I shared with you earlier in the year your contact or council representative to feedback to, and I would encourage you to do so and make your voice heard. The next meeting is in October, but we can start to form the agenda in advance. As well as you contacting them, they may reach out to you on occasion to get your views and input (don’t worry, you won’t be bombarded, they are as busy as you!). Can you please make me or your DM aware if you would rather we didn’t share your email address with them.

Informal Incentives

This time last year I wrote about the introduction of an Informal Incentives Policy for agencies. As a Financial Services Institution, YBS are careful to make sure we and all associated 3rd Parties are compliant with FCA guidelines. Whenever we, or any of our 3rd parties, such as Agencies, offer financial or non-financial rewards to employees we have to ensure we always have the customers’ best interests at heart and that we are ensuring good customer outcomes. As we are undertaking a 12 month review of this policy, can you please check in with your DM so we can ensure any existing schemes are still appropriate. Or if you are planning to introduce a scheme there is a process to follow in the policy which you will find on the Proprietor Operations Manual on sharepoint.

Summer break

Although officially the Covid restrictions we have lived with and adapted to for so long have officially ended in much of the UK, things are still far from normal, and I’m sure the same applies to your holiday plans. I do hope you still get to have a well-earned break with your family and friends and recharge for the rest of the year. The Digest will also be taking a summer break in August, but will be back in September. Please feel free to send feedback and ideas for any future digests.

Thanks

Dave