Dave's Monthly Digest - March 2022

by David Smith, on Mar 29, 2022 4:39:30 PM

Welcome to the first digest of 2021. As we’ve had a short break from the monthly digests there’s a lot to update you on – including what’s happening in the network, savings performance and plans.

This month’s blog is a refresher on how the business works; how interest rates are calculated, the impact of the Bank of England, and the unique relationship shared by our borrowers and savers. It will be useful reminder for your colleagues and should help with customer conversations.

Following the restructure, I hope you’ve found your conversations with your Retail Area Manager (RAM) enjoyable and valuable. You should have had chance to discuss plans for 2022 and beyond, agreeing how you’ll engage going forward and where and how you and your team can integrate into your wider area team.

Integration and alignment were the primary drivers behind the structure change, and there’s been some positive steps in this area:

Desktop refresh migration completed in March

From the WAN upgrade, server refresh to the desktops and Windows 10, we’ve made some excellent progress. There’s a small number of issues outstanding, mostly around passbook printers, but IT are working hard to get these resolved as soon as possible. The migration of outlook mailbox to the cloud has caused a few niggles for your teams, but it’s also being worked on.

What this means - your teams will have noticed:

- A significant increase in system speed

- Internet access

- Linked to the additional capacity of the network, we’ve been able to update the YBS group information security policy. This means your agency colleagues who could only send emails to other YBS addresses (internally) will now be able to email outside of YBS from their personal YBS email, as well as from the main agency Inbox. This should make communicating with your customers (and with you!) much easier.

- The guidance, rules and updated policy information was shared on 7 March. Please ensure the information security policy is adhered to, as breaches could lead to the colleague responsible having their YBS access revoked, which could impact on the ongoing operation of the agency.

A big thank you to you and your team

We recently announced our annual results and to quote Stephen White, “Against a unique backdrop, 2021 really was a standout year and we should all be very proud of the results we’ve achieved”. I would just like to further endorse this and thank you and your teams for the key role you played in this standout year. You’re very much part of the ‘we’ that Stephen refers to, and I’m confident that the changes we’ve made and continue to make to align agencies mean that your role will be even more key in 2022.

You can find more details on our results in the press release and the information for colleagues.

For the first time we now have more agency locations than branches

Existing proprietor Debby Johnson of Dee Mortgages/Mortgage Advice Bureau has recently opened an agency in the converted Llandudno branch, our 116th agency. This balance will continue to shift in favour of agencies with more conversions planned this year.

Whilst the Retail Distribution Team are clearly big advocates of the agency network, please see the recent intranet article all about agencies, to raise awareness of the role you play and encourage the whole business to consider and factor agencies into their thinking.

Monthly risk checks have changed – make sure it doesn’t impact your commission

As a reminder the monthly risk checks carried out by your teams have been refined to ensure they are managing the current risks - your colleagues have received training on the differences and been reminded of the importance of these operational controls. To enhance the effectiveness and efficiency of these checks, from 1 April they’re being moved to the system like the branch checks (another alignment tick). Main changes highlighted below:

The completion of these checks should be well embedded after three years, and as you are aware they contribute to the Quality Assurance/Bonus component of your commission payment. The additional (and manual) post deadline reminders will no longer be sent to you, (the team will see an auto-reminder in the agency inbox). So please ensure your team have a robust system in place to ensure these checks are completed each month to prevent your commission being impacted.

We need your help - some important messages are still not being received by some agency colleagues

So can I please remind you of your responsibility to ensure your colleagues make time to complete the weekly Retail Brief (Closed for Training) packs, to read and understand the Retail Network Weekly Update (RNWU) each Friday, and access the Agency inbox regularly each day to check for important messages and updates.

2021 was an exceptional year for YBS mortgage performance and 2022 has got off to a great start too.

- Our Direct Mortgages Team continue to see new and existing customers wanting to secure a new rate and a record number of existing customers wanting to borrow additional funds to enhance their properties.

- Further anticipated increases in the Bank of England base rate this year is expected to support the continued demand for mortgages whilst rates are still relatively low compared to historically high rates.

- 9 months ago, we introduced a new process for retail colleagues to introduce customers to the Direct Mortgages Team. Over 1,500 customers have used this service with many proceeding to application stage to either purchase a new home, or to refinance their existing property. Customer feedback has been really positive referring to the efficiency of the process and that an agreement in principle was approved within minutes.

- Agency colleagues currently introduce customers through a manual call back request – but we’re exploring providing a direct line to the Direct Mortgages Team which we currently have in place for branch based colleagues.

- We’re also in the process of creating bespoke support material to help agency colleagues have proactive mortgage conversations with their customers. Similar material recently delivered to branch colleagues boosted knowledge and skills and helped them feel more confident approaching these conversations.

Over the coming weeks and months, your Retail Area Managers will be looking at how we can work together to maximise mortgage opportunities within the agency network. We’d love to hear your ideas on what would work for your location and any feedback on using the referral process. Please send to me, or your RAM who can pass onto Sarah Graham (RAM) and Adeel Qureshi (DMT) who are leading this work.

We got a panel of our experts together to give you an update

- Steve Robinson (Savings Product Manager) - our performance so far and our current competitor position

- Chris Irwin (Director of Savings) - the BOE rate pass on

- Richard Patterson (Commercial & Product Development Manager) - the propositions to come as we work through 2022 to achieve our ambitions.

A caveat from Steve and Richard that these are the current plans which are subject to change based on our own priorities changing, or changes in the market – both of which have happened already in 2022.

Firstly Steve, “We started the year with more a modest forecast from a balance growth perspective compared to 2021 given the challenging market we were entering into. Whilst the market remains a challenging one, we have started the year very strongly on the mortgage side of the business which has allowed us to re-assess our savings ambitions/growth targets for 2022. We have therefore increased our savings targets to meet our lending ambitions, particularly for H1 2022 and as you can see from the graphs below we are seeing our volumes pick up significantly in recent weeks and anticipate continued over performance during upcoming ISA season”.

You may have already seen that following the BOE base rate increase the majority of our off-sale variable savings products are rising by 0.25% in April. The rate increase will be implemented from 5 April 2022 and will put approximately £50m back into our members pockets and again outlines the significance of us being a mutual organisation. The unanimous view from the business regarding the BoE rate increase put simply was ‘we can, so we should’.

Chris Irwin, Director of Savings, “Our decision today to not only pass on at least the full Bank rate rise to 96% of our existing variable rate savings book, but to also make further increases to most of our accounts continues to reflect our mutual ethos of putting our members first. Supporting our savers is a key element of the Society’s purpose, ensuring we deliver value to our members, which in turn supports their financial resilience so we’re delighted to be able to make further increases to our savings products especially in the current financial climate. As a result of our decision today, 99% of our interest-bearing variable rate accounts will benefit from increased interest. We’re conscious times are tough for savers. To help deliver better value for our savers, we always try to offer the most competitive rates we possibly can, the Society paid 0.32% above the rest of the market average in 2021, which means savers benefited from an additional £107m of interest.”

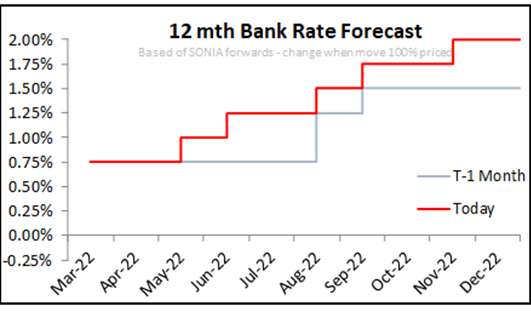

It is widely expected that BOE will continue to rise throughout the remainder of 2022 (see below current forecast).

On our Competitor Position, Steve shared, “Whilst the market remains volatile given the current macro-economic environment the swap rates continue to trend upwards leading to high levels of activity/movement in the fixed range space. We remain well placed despite the current level of activity and have today (24th March 2022) relaunched our FR ISA range to enable us to remain competitive during ISA season.

In the variable market we continue to remain competitive through both our online and network channels. We will monitor closely competitor response following the BoE increase on 17th March 2022 with the aim of ensuring this remains the case.

Our ‘Back book’ savings rates were already very strongly placed prior to our planned increases from 5 April 2022 and we anticipate our move to increase them further will support stronger retention performance. This alongside the launch of our first loyalty proposition of 2022 we expect a strong ISA season and one that enables us to continue to achieve our stretched objectives referenced above”.

Early in Q2 Steve and his team will be looking to re-forecast for the remainder of the year and will evaluate our over performance year to date and the growth balance we need to achieve by year end.

Now over to Richard, “Our Loyalty activity in 2022 will be spread across the whole year, and be for branch/agency and also online to share both the demand and workload (caveats mentioned above apply to this section especially)

- Loyalty 6 Access ISA (launched by the time you read this) to run until May/June, and this launch date will help retain some of last year’s loyalty ISA maturities as well as new money focus

- Loyalty Fixed Bond (s) to be launched June/July

- Loyalty Reg Saver to be launched Aug/Sept at the earliest

- Loyalty Pass back activity Sep/Oct (a smarter tiering approach – for example an increase on first £20k of back book accounts)

- Then another Christmas Reg Saver launch Oct/November

Other Savings Development

Smarter tiering will first be trialled as a ‘test & learn’ on an inter-generation kids’ product – this will help us test functionality on a smaller demand/non-targeted product– details TBC but probably end of Q2 launch

- Looking at the prospect of creating a National Savings Week focussing on financial resilience, education and awareness alongside other partners with a product/proposition to support (still very early days on this)

- Early discovery work being completed around a Green Savings proposition”

Thanks to Steve, Chris and Richard for their insight. I’m sure you will recognise the balance growth performance that Steve refers to in your own agency, especially the uptick shown in the graph above from February onwards. You should be reassured that you’ll benefit from our position in the savings market and that we have really attractive propositions both now and coming down the line.

We’ve already mentioned the commercial benefits of us being a mutual organisation, and our community activity provides further evidence of our purpose. Our Community Engagement Lead, Kerry Shaw, updates on community activity.

Small Change Big Difference:

- 2022 has started strong with the SCBD opt-in rate sitting at 50.6%, which is just slightly lower than our target of 51%! What a brilliant start to the year, let’s keep that momentum growing.

Age UK:

- The money raised from all the different fundraising activities from POS to challenge events is essential in helping us hit our charity partnership target of £1 million. We are already off to a good start this year and, as a business, have raised nearly £14,000, with branches raising £4,777 and agencies raising over £500.

- All money raised goes towards funding the Building Better Lives programme which was created in collaboration between Age UK and YBS. The programme aims to provide one to one support to older people in times of financial challenges and is closely linked to the YBS purpose 'Real Help with Real Lives. So far we have been able to 1717 older people in need.

New in 2022

- 2022 is now well underway and we are hoping to surpass the number the 2,128 young people we supported in 2021 and need your help to get there.

- January and February were busy months for delivering Money Minds and Career Minds sessions with 13 Career Minds sessions being delivered which reached 157 young people and a huge 94 Money Minds sessions delivered already which reached a whopping 1,385 young people.

I hope you’ve enjoyed this month’s digest, and forgive the length of it, there was so much to update. Any questions, or feedback I’d love to hear from you either directly or via your RAM.

Thanks

Dave