The importance of channels working together and helping your customers to embrace the digital world

by Catherine Nessworthy, on Jul 29, 2020 10:31:44 AM

The world, and the way we do lots of things is changing very rapidly. The way we listen to music, read books, shop, bank, are now done online much more than they were in the past.

As an organisation, we recognise that we need to provide digital options for customers. The Covid crisis has increased the numbers of customers using online channels, as they have been unable to physically come into our branches or agencies.

The crisis has also shown us that during these times, we need to provide the best possible service for our members - it’s about seeing the bigger picture. Given changing customer habits, if we don’t offer digital capability, customers may start looking elsewhere for it. We believe that the best possible service comes with integrating digital channels with face to face, and providing customers with choice. We’re committed to servicing customers face to face, but there are occasions (like checking balances for example) when going online just makes more sense.

It’s about retention and ultimately, if a customer closes their account, YBS loses the customer and the agency loses their commission.

Dave Smith says:

'Customers now expect to be able to do certain things online/mobile, and if we cannot offer this we risk losing the customer altogether putting balance commission at risk. Agencies can still benefit by providing that excellent face to face service at account opening and account review time, which is where we see face to face as our competitive advantage over our competitors'.

In this blog, we’ll talk about how online and offline channels can complement each other (like agencies and branches). There’s also some information about the new YBS mobile banking app, and some ideas to help you help your customers to protect themselves when they use online channels.

It’s about customer options and preference

Here’s how online channels can complement and support the agency network:

- A multi channel approach provides the customer with more convenience and choice. This is critical for keeping up with our competitors

- It helps our self-service/digital agenda as an organisation

- Allowing customers to do quick and simple things online, such as changing their address, frees up your time for more meaningful conversations and transactions when they come in

- Overall, it ensures that we’re providing the best possible service to our customers.

Different channels for different purposes

We know that online channels are cheaper to run, so the pricing for online products is more competitive.

Liam Williamson, Savings Product Manager says:

'We have to take into consideration the costs of offering and maintaining these products, and where they are placed in their respective markets. We have to make sure the products are competitive. We also need to look at where demand lies in each channel. For example, we often offer notice products in branches/agencies but not online.

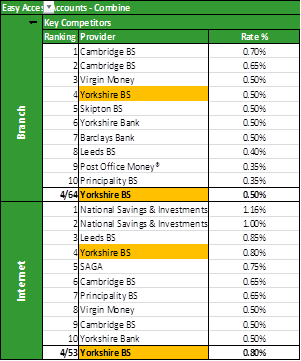

As you can see from the table below, the top paying product in the branch/agency space in July 2020 is currently 0.70%, with the top paying online product paying 1.16%. The online channel is offering higher customer rates. This is because, operationally, it has a lower cost and there is also a larger demand for online savings. We need to ensure that we are equally competitive in both markets'.

Rates quoted correct as at 16/07/20

We also need to bear in mind that, in January 2020 the top paying variable branch product was 1.35%- as was the top paying online product. However, following the recent BBR changes and lockdown, the market has changed significantly and the gap between branch/online has widened. We need to make sure we’re adapting our range in line with this.

However, it’s not just about rates. Different channels can, and should be used in different ways. So they have different jobs, rather than competing against one another. For example, agencies can add value in a way that online channels can’t. So when customers want more interaction, or to have an in depth conversation about what’s on their mind, that’s when an agency can show it’s true potential. Even when considering product rates, some customers would rather have a lower rate and benefit from the face to face service.

Online services are generally more transactional, and therefore used when a customer knows exactly what they need or want.

Audience choice

Traditionally, face to face channels have attracted older, less digitally-savvy customers. But, it’s important that (as coronavirus has shown) they understand the benefits (and risks) of using digital channels too. Similarly, we need to attract younger audiences into agency. Things like events on subjects of interest can help with this.

Talking to your customers about staying safe online

Part of your added value service could be talking to your customers about the best way to stay safe when they do use online channels. This is very much a current issue, as coronavirus has increased online fraud.

Our online security blog here can help with this.

The arrival of the mobile app

We want to make sure that we stay relevant and continue to meet the needs of our customers, as well as keep up with our competitors. That’s why we’re launching our new mobile savings app.

We are busy building the app at the moment and testing it with a small pilot group of customers. The app will help our savings customers access all of their accounts easily and move their money around. The app will be coming soon.

To find out more, visit www.ybs.co.uk/savings-app

What should I do with the information in this blog?

- Share it with and discuss it with colleagues. We appreciate that some of the subjects covered are on the sensitive side and may promote debate

- Read and share the online security information with customers

- Look out for more information on the app

- Think about how you can provide the best experience for the customer overall, using all the available channels

- Get in touch with us if you have a view on this article – we really value your opinion.