Catch up with Dave - May 2022

by David Smith, on May 24, 2022 11:07:23 AM

Market Update

Savings

- The Saving Market net flows graph below shows the contrast between the challenging market in 2022 (green line) to previous years.

- The cost of living continues to rise dramatically and with inflation rates up to 9% and currently forecasted to increase as high as 10% later in the year, disposable income continues to be hit as energy bills, fuel and food prices rise – all clearly impacting the ability to save.

- We’ve seen four BoE base rate increases since December 2021, from 0.1% to 1%. Current forecast anticipates another four rises before the end of 2022, potentially rising to 2%.

- We’ve responded to BoE increase with ‘raise the floor’ activity for our back book - 0.85%/0.90% for unrestricted/restricted access products with incremental responses to the BBR changes year to date.

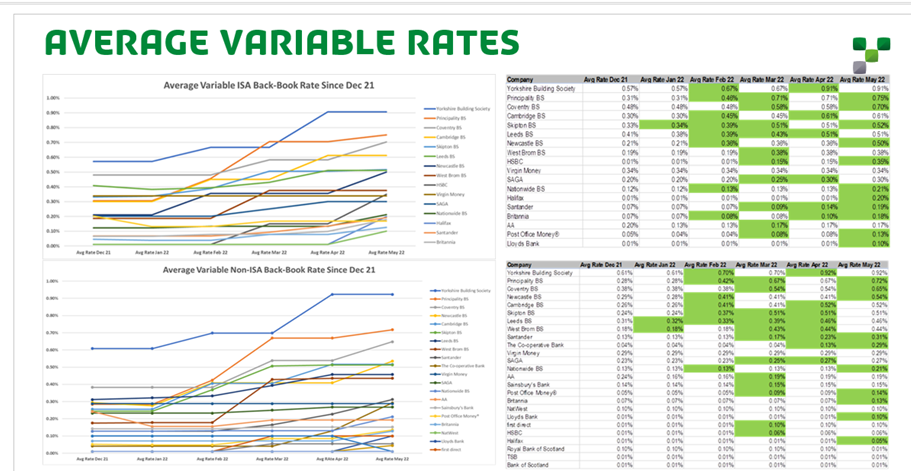

- Our average back book variable rate is very competitive as we continue to pass on value to our members:

So how are we doing?

Whilst there has been very little by way of an ISA season this year, we’ve performed very strongly from a savings perspective.

We spotted an opportunity in the market to increase our online savings rates at the end of February and during March, putting us in a very competitive position and providing exposure on a key platform (Money Savings Expert website) to drive volumes. We’ll continue to look for opportunities to do this if it is beneficial for the Group to sometimes have differential rates to attract the online market. The retail network however isn't being neglected, far from it.....

Our first loyalty proposition of the year - the new Loyalty Six Access Saver ISA issue 2 launched on 24 March and the network version has attracted balances in excess of £1Bn with £220m being new money - a great start to our loyalty plans for 2022.

All this means we already surpassed our 2022 original balance growth ambitions by the end of April. We are currently working through Q1 re-forecasting, our overall 2022 balance growth aspirations will be significantly higher than originally set at the beginning of the year.

Well done to you and your teams - by the time you read this the agency network net flows will likely have surpassed +£200m in 2022, with all but a handful of locations showing positive net growth.

What’s next…

We have plenty of propositional plans in place to support growth and it’s a really positive outlook for the rest of the year. Here’s is a taster of what’s coming next:

- Loyalty Fixed Bond will be launched mid-June

- Loyalty Reg Saver should be launched near the end of July

- Our first ‘smarter tiered’ product which will be a family product. It will target parents and grandparents hoping to support or contribute towards younger relative’s university costs. We’re looking to launch at the beginning of July and this product will also be used as a ‘test and learn’ of the smarter tiered functionality to support further loyalty pass back activity currently scheduled for Q4 2022, meaning bigger benefits for more customers

- Finally, there are plans for another Christmas Reg Saver either at back end of this year or early 2023.

Mortgages

- The direct handover line to the Direct Mortgages Team is now live for agencies! Don’t forget this is in addition to the existing call back facility.

- A CFT session went live on 11 May – a useful reminder of the referral process and to introduce the direct handover line. Following your feedback, it also includes how you can track referrals via a SharePoint site, so you know if its progressed to application and a referral fee.

- We’re still busy working on bespoke materials for with Sales Policy to help with proactive mortgage conversations - boosting knowledge and confidence. This follows on from the success with branches using similar materials.

We want your feedback – we’ll continue to make improvements where we can based on feedback from you, your customers and the Direct Mortgage Team. You can contact your Retail Area Manager (RAM) with any thoughts.

Need any help on mortgages? Each area also has a mortgage lead who can support you with everything to do with mortgages, just ask your RAM.

Do you submit direct mortgage business? Remember to refer to the YBS Mortgages in Agencies on the Proprietor SharePoint for details on registering advisers, permitted case types by brand, and the process to follow to submit/query a case.

We’re pleased to launch our new Linkedin Networking Page - a great opportunity to enhance our relationship together and build on the existing channels we already use.

Thanks to Sharon Stirling, Retail Area Manager in Scotland North for developing this. We’ll continue evolving this page, but the main aim is to share important updates relevant to you and your teams.

It’s a private group open to invited members only. A space to showcase different learning opportunities, links to tools that can support your teams, share best practice, highlight key dates of interest (upcoming proprietor council meetings etc) and take a steer from you on what you want or need from us. We would of course also welcome any feedback on what you would like to see featured on this page.

What you need to do - please join the page via your Linkedin Profile to keep up to date and to help support our own mutual commercial growth aspirations. As always anything specifically relating to your location, please always reach out to your RAM.

What happens next - once you join you’ll have access and receive notifications for any posts – and its perfect for accessing via your mobile device. If you have any questions your RAM will be happy to give you a demo on how the page operates.

Outbound Calls

We’ve had to make a change to our outbound calling activity. Because so many of our maturity calls naturally lead into a conversation about other products (most notably on-sale bonds/ISAs, of course) we’ve identified that they could/would be seen by the Information Commissioner Office (ICO) to breach the terms of a ‘service’ call. Whilst we – and the FCA - want to do the very best we can by our customers, and to make their money work as hard as possible, our customers haven’t given explicit consent to be contacted for that (unless they’re opted-in to telephone marketing).

So, we’re caught in between two regulators and their priorities, and need to adapt accordingly. Here’s what we’re going to do:

- In May & June we’ll only be making maturity calls to customers who are opted-in. This will significantly reduce the volume of maturity calls to complete but allows us to contact as many customers as possible under the circumstances. It also means that we can have conversations about other products and services – it no longer needs to be customer-led.

- We’re going to use that time to assess the impact of this reduction on retention and make a more informed decision about next steps. We may find that calling all customers every month provides a diminishing return on investment, from a commercial perspective – that will be valuable insight, but not the only factor.

- We’re going to work up a simple disclosure, along with a bit of training, for our people to use while calling if we do decide to go back to the service call model.

That means your teams will see much lower volumes of maturity calls in May and June. It may be that we use that headroom for more/different outbounding activity, and that will be shared via the usual channels if we do.

As a reminder there is some guidance on the proprietor SharePoint on Outbound Calling and for your colleagues on the intranet on telephone skills (a previous closed for training/retail brief). This month's blog also covers outbound calls.

New Agency in Southport

We opened our 117th agency in mid-May when we converted our Southport branch in partnership with KBA Financial Services, this is proprietor Sarah Hogan’s 3rd agency after KBA previously completed conversions in Nantwich and Bury.

We still need your help - some important messages are still not being received by some agency colleagues

Please remember to ensure your colleagues make time to:

- Complete the weekly Retail Brief (Closed for Training) packs

- Read and understand the Retail Network Weekly Update (RNWU) each Friday

- Access the Agency inbox regularly every day to check for important messages and updates.

To help whenever there is a free retail brief slot, we’ll link to the page which holds the previous packs so these can be revisited. This activity isn’t restricted to Wednesday mornings, so please help coordinate regular time for colleagues to keep updated

Reminder of the contractual Minimum Standards

We’ve seen an increase in the number of requests that require us to undertake some due diligence. As a reminder a minimum of 6 months is required before the intended effective date of any proposed changes. This is referred to in the agreement (clause 5.1.25), and also contained in the contractual Minimum Operating standards (MS02-01)

Proprietors must inform the YBS Customer Division Business Support team immediately of:

- Intention to sell - Any intention to sell the agency. Please also see the agency agreement detailing related consent fee.

- Structure or business changes - Proposed changes to the non-YBS business, Proprietor(s) or directors.

These include, but are not limited to:

- Change of company trading status, name and/or type of company (e.g. LLP to LTD, Sole trader to Partnership)

- Change or sale of Shareholding structure

- Takeover or sale of business

- Change of premises including planning consent, notifications and restrictions.

- Change to lease

- Director changes including director leaving the business/Change of ownership

- Any inability to provide information requested or a change that causes an inability to meet any of the minimum operating standards

Community

Small Change, Big Difference- The current opt-in rate for SCBD across the retail network is 46%, just lower than the ambition of 51%. In order for us to able to support local charities through the Charitable Foundation, we need members to opt in to SCBD.

- Thank you for all your support with the Spring Action Days, we raised £10,492.

- There's still time to sign up and get involved in the Pennine Walk, taking place on the 23 June. You can get involved in a virtual event, 10 miles or 20 miles. There's more information on the latest Pennine Walk internet post.

- All your efforts fundraising for Age UK enables YBS to support older people with managing real life. Throughout our partnership, we've been able to help 2,141 people and have helped them unlock £4,049,235 of potential benefits entitlements.

- We're thrilled to be hosting the first-ever weekend colleague, friends & family-fun day on Sunday 18 September from 11am -5pm. Think Total Wipeout meets school fete; there will be inflatables, stalls, food and entertainment for all ages. Bring your friends & family and head on down to Low Moor Holy Trinity Cricket Club (BD12 0QB).

- National Numeracy day is the 18 May, to celebrate we're sharing the success of Money Minds. As a business, our Money Minds delivery is up by a whopping +302% since 2021 and we've been able to reach 4,546 young people.

- At YBS, we are driven by our purpose, Real Help with Real Lives. We want to help people achieve greater financial wellbeing and know that knowledge and understanding of managing money are essential to enabling healthy financial habits. This goes hand in hand with preparing young people for the world of work, as employment plays a big part in maintaining long-term financial wellbeing.

- So, we are thrilled to share the exciting news that Money Minds has gone online! As part of the business's purposeful investment of £1.8m into a variety of community projects over 2021-2022 we have been able to expand the programme to digital and launch a free Money Minds. This will enable us to increase our reach and continue building on the impact of our in-school Money Minds and Career Minds activity, which have reached over 35,000 young people since 2015.

- To support the retail network in talking to customers, posters have been sent out which should be added to the community noticeboard. Further details will be included in the upcoming closed for training.

- Share the platform with the young people in your life: Spend some time looking around the site yourself and see what you think. Please speak to the young people in their life about finance and start the conversation.

- Talk to your friends and family about Money Minds: Encourage the people you know to start using the material from the comfort of their own home.

- Talk to your local schools about the new online platform: If you are delivering Money Minds or Career Minds in a school, don't forget to tell them that they can now access Money Minds material from the comfort of their own home or deliver a session themselves in the classroom.

- Share the website on social media with #moneyminds:To help spread the message we would like you to share the YBS post on your own social media page.